Get saving.

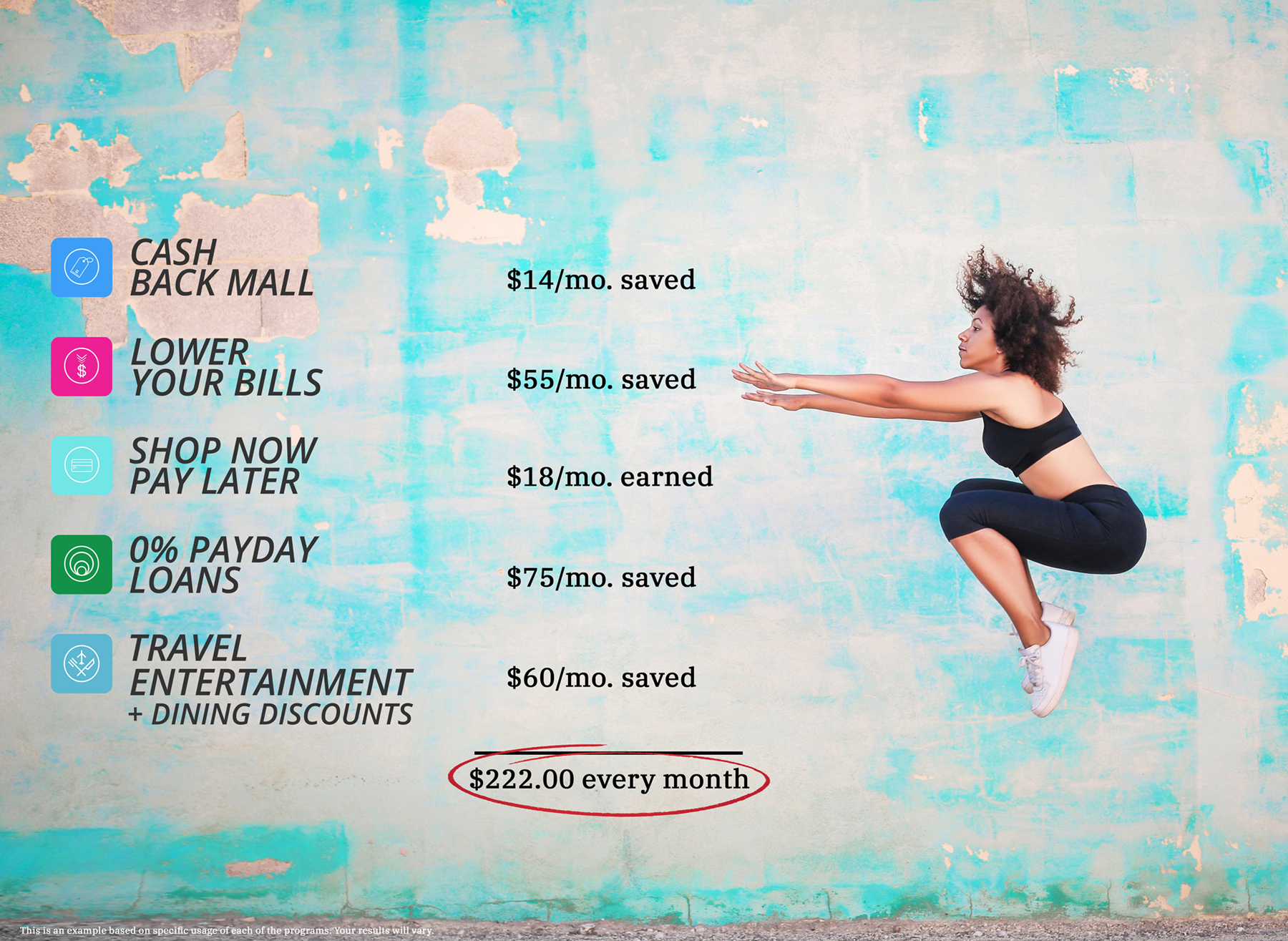

We designed LIVING 2.0 Save—literally—to save you money all over the place: we can cut your utility bills, mobile phone bills, internet, TV and more. We can save you on necessities and take out. We can get rid of bank overdraft charges, we can lower your student loans by up to 40%. We can even get you 0% payday loans… we’ve got 3 different programs for cash back shopping. And did we mention we can pay you cash for exercising?

That’s why we put save in the name. Click below to explore each program.

0% Pay Day Loans + Instant Cash Back

Get access to your paycheck immediately - with no fee! Plus 3 more money saving benefits!

Read MoreGet Paid To Exercise

Earn for every calorie you burn. Get paid to improve your health and fitness!

Read MoreSmart Medication Manager

Resolve medication administration issues for seniors. Take the right amount at the right time.

Read More

Travel, Entertainment, and Dining Discounts

Get discounts on Take-out and $100’s in Grocery coupons. Plus guaranteed lowest price for Hotels + Resorts, entertainment, + cash-back shopping.

Read MoreShop Now, Pay Later

Shop millions of products and pay over time. Pay no interest (that's right, none).

Read More